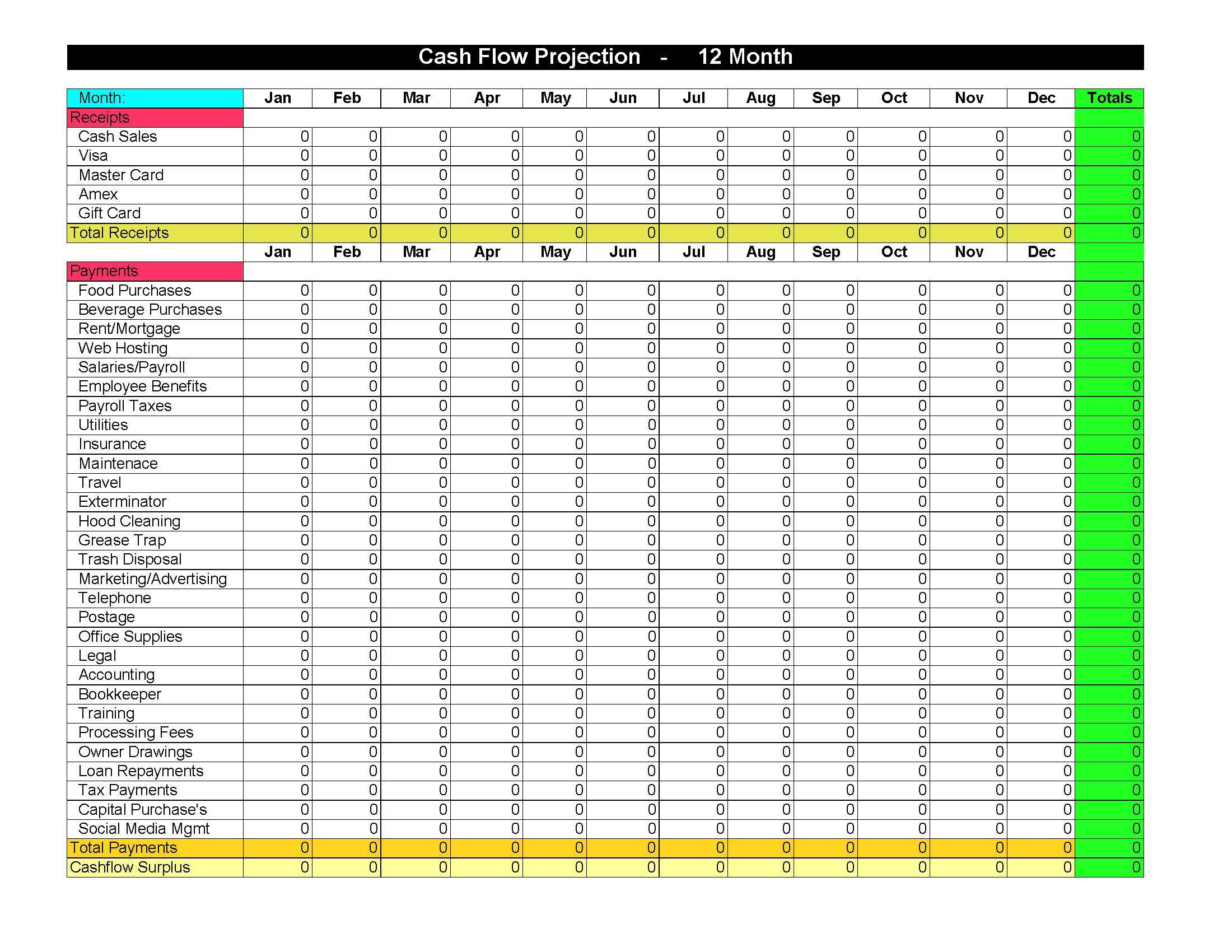

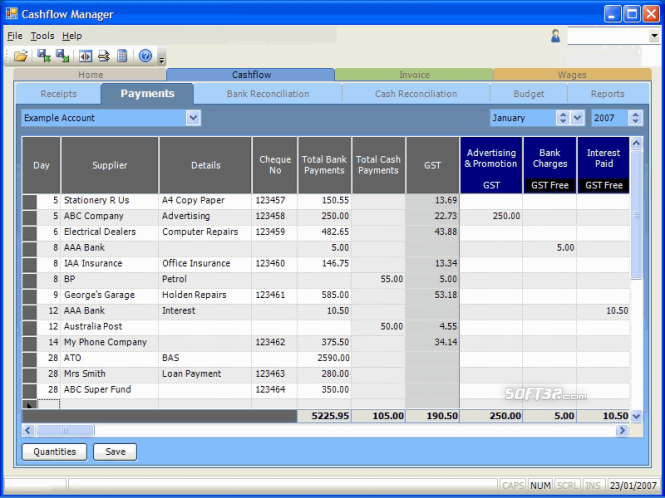

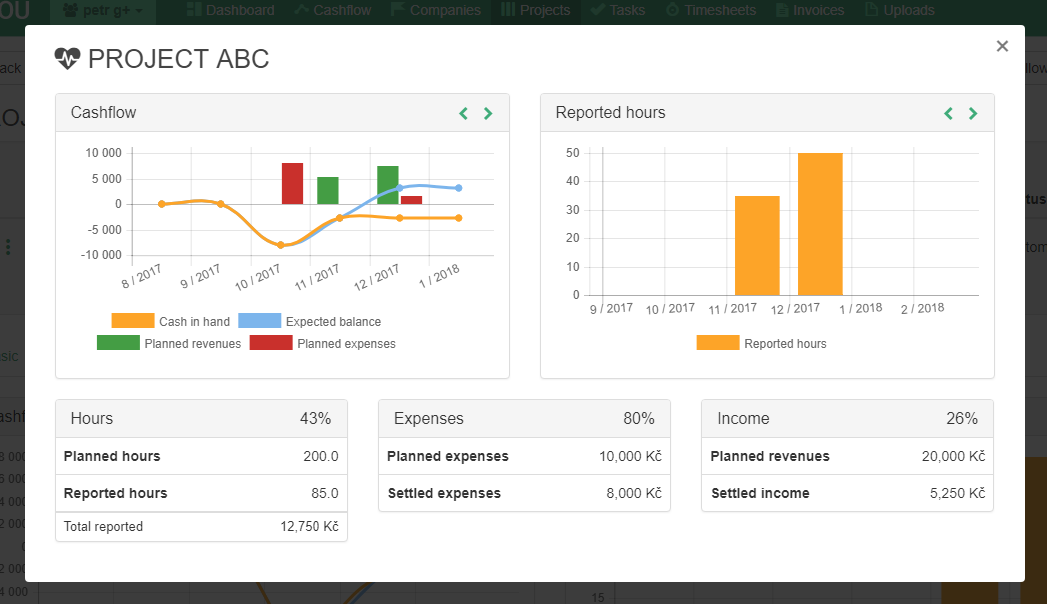

By linking up with each of the subsidiaries’ own cash management software systems, the group level executives can at any given time assess the cash flow situation, analyse it, and make determinations using their own system of the future state of the company’s cash flow. For instance, a multinational group may have a number of subsidiaries from which it will need to assess the volume of cash currently at its disposal. The right cash flow forecasting can be plugged into a number of different systems to pull in the correct and relevant data, but also to output it to relevant points for analysis and review. Here, the initial step of cash flow forecasting is made much more approachable. Using the correct software, a company can fully automate the process of data gathering, schedule for appropriate times at the company’s discretion, and position the data in a way that is simple and manageable for managers to assess.

Without automated systems, data can go missing or be difficult to find and schedule, and drain significant time and resources from the actual running of the various arms of the business. Cash flow management software’s ability to collate and harmonise data takes a huge strain off managers and those in the treasury department. The software should pull together all relevant data from the various arms of the business – including the group level profit and lose and cash flow statements if that’s how the company is formed – collate, harmonise and present the data in a clear and reliable way that is understandable to the treasury managers. There are five primary functions a company will wish for from its cash flow forecasting system: A third option is in entering the software as a service (Saas) market, in which a third party will supply software and its maintenance throughout the course of a contract with specific functions such as cash flow forecasting and risk management analysis.Īnd there are a variety of variables a company must weigh up when appraising which cash flow forecasting software packages to use. Other firms buy so-called “white label” systems, in which they purchase software from a third party, implement it into their own systems, and sporadically buy updates as and when it requires. This option provides the firm with the benefit of being able to build the system with to their own specific requirements, should they need them. Larger firms – such as banks and the bigger investment firms – have developed their own, in-house packages they have tailor-made using external or internal technology and business consultants. But choosing the correct package can be pivotal to a firm’s financial health.Ĭompanies have, on the face of it, several options to consider when analysing what type of system to use. The function of cash flow forecasting is of such importance to a firm’s understanding of how it stands, and how it will direct future investments and pay off debt obligations.Ī significant amount of resources go into the actual calculation of forward cash flows, including both objective and subjective analysis of the cash flow statement, that a number of companies have brought sophisticated cash flow forecasting software to market to provide organisations with the ability to more quickly and easily assess cash flows.

Forecasting cash flow is a crucial element to the treasury function, providing guidance on a corporate and business level, and allows a company to look at its capabilities – both current and in the future.

0 kommentar(er)

0 kommentar(er)